Chinese takeover of SolGold won't erase problems with Cascabel

US $1.2 billion solgold buy-out by Jianxi Copper is unlikely to erase existing concerns with SolGold’s flagship Cascabel mine, and other priority projects in Ecuador.

Please attribute all quotes below to Liz Downes, member of Rainforest Action Group, Director of Rainforest Information Centre.

Chinese mining giant Jiangxi Copper has been given the go-ahead to take over SolGold in a US $1.2 billion deal. The aggressive bid has Jiangxi Copper paying a 43% premium over November 2024 trading prices. The move strengthens Chinese mining positions in Ecuador, with the only other currently operational copper mine in the country – Mirador – also a Chinese asset.

Large SolGold shareholders BHP and Newmont previously expressed the support of the offer. This offer provides a convenient way for the two mining giants BHP and Newmont to reduce their holdings in Ecuador, particularly in the wake of considerable public unrest and the growing narco-trade, both of which have disrupted explorations across the country.

A previous Rainforest Action Group report shows that Jiangxi is no stranger to controversy, with serious environmental pollution at most of their mines in China and their former vice-president jailed for 18 years for corruption and embezzlement.

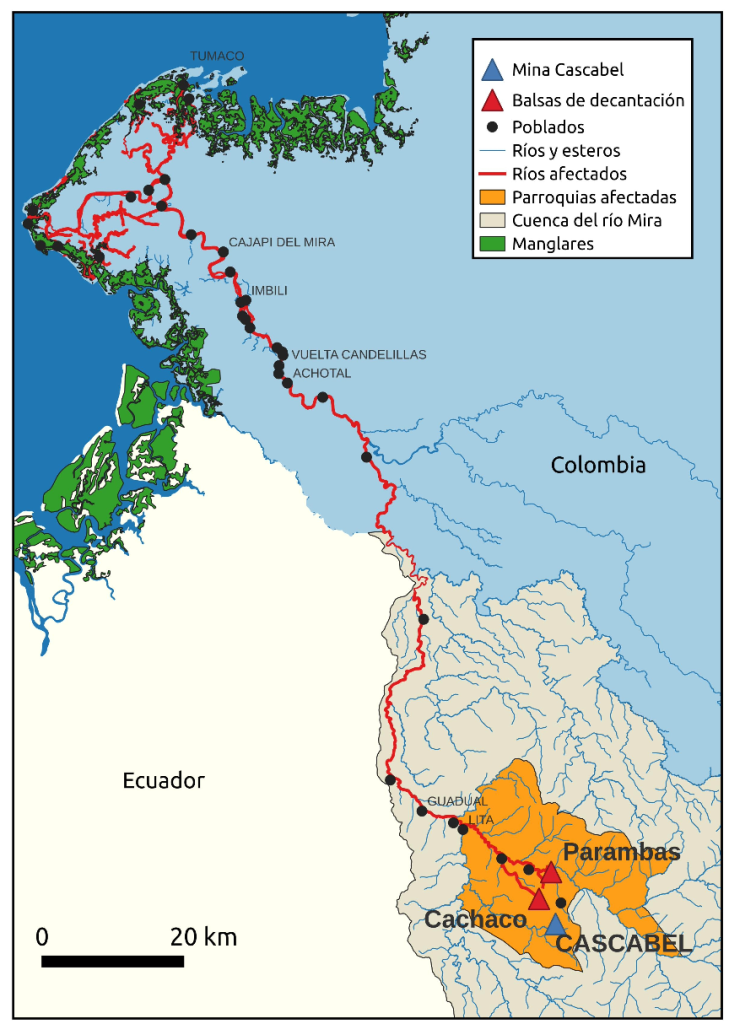

This buy-out by Jianxi Copper is unlikely to erase existing concerns with SolGold’s flagship Cascabel mine, and other priority projects in Ecuador. The latest report on SolGold from the Rainforest Action Group highlights research that shows SolGold’s waste management plan carries the risk of devastating waterways, ecosystems and the communities dependent on them, beyond Ecuador into Colombia. Research by Steven H. Emerman also found that SolGold may have significantly inflated the figures it states for the size and grade of the Alpala and Tandayama deposits in its 2024 pre- feasibility study.

Likewise, growing instability in the region is making it difficult to establish a mine or keep transportation routes open. Since Daniel Noboa became president and forced through a series of unpopular presidential decrees, there have been a series of violent clashes over raised fuel prices which left several protestors dead and 12 soldiers injured in September.

In August, Noboa axed the Ministry of Environment and incorporated its responsibilities into the Ministry of Energy and Mines. The rights of environmental groups and environmental activists were also severely curtailed by a new bill ostensibly to reduce money laundering, but which will primarily impact civil society organisations, NGOs and community groups.

Environmental defenders are concerned that the law will be used to persecute them – particularly now the Ministry of Environment has been eliminated.

Research by Do Yong Gong et al has shown that increased Chinese foreign direct investment results in a rise in anti-Chinese protests. Jiangxi’s bid, coming on the back of existing unrest may drive further protests – this time against Chinese investment.

Meanwhile, Cascabel’s position in close proximity to the Colombian/Ecuadorian border, will weigh heavily on Jiangxi Copper. Reports by RAYA detail how Ecuador is becoming a significant conduit to move cocaine from Colombia into Europe, with 57% of the banana containers leaving Guayaquil reportedly arriving in Europe with drugs.

The media outlet shared Ecuadorian police documents detailing how President Daniel Noboa's family has been implicated in moving more than half a ton of cocaine since 2020 to several European countries through its banana company, Banana Bonita.

Once Cascabel is established, Jiangxi will need to transport mining material 150-200 kms through San Lorenzo, a known organised crime hot spot, to the port of Esmeraldas, where there is significant organised crime activity.

The new unrest on top of the increasing narco-trade in Ecuador, and decreased environmental rights, adds to existing concerns about the operations of mining companies operating in Ecuador, which need a consistent police and military presence to be viable. SolGold may well be laughing all the way to the bank at escaping such a perilous and challenging situation.

- The Rainforest Action Group update on SolGold includes project timelines and an overview of the other priority projects in Ecuador.

- Link to the Rainforest Action Group report en Espanol aqui.

- A 2023 Rainforest Action Group report on Jiangxi Copper highlights historic concerns with the mining company.

FULL MEDIA RELEASE HERE INCLUDING CONTACT INFORMATION